In July 2019 PayPal launched Xoom in Italy, the service that allows you to send money abroad in a simple and cheap way. Let's discover all the features of a service currently active in 32 European countries and in 160 countries around the world.

Xoom: what it is, what it allows you to do

Xoom has been active since 2001 but has increased its visibility and expanded its range of services since 2015, when the San Francisco-based company was acquired by PayPal.

Today a number of operations are possible with Xoom, and more in detail:

- send money to a recipient's bank account

- send cash for in-person pickup or home delivery

- pay bills from abroad

- make phone top-ups.

Of course, the core of Xoom is the ability to send money overseas at competitive rates.

Download QR-Code E-commerce with Paypal. Complete Developer's Guide Developer: Unknown Price: unknown

Download QR-Code E-commerce with Paypal. Complete Developer's Guide Developer: Unknown Price: unknown

How it works

By relying on companies, companies and banks in the country of destination, Xoom allows the beneficiary (depending on the company involved) to withdraw the money at the branch or have it credited to the account. Or even, in some areas, to have it delivered to your home.

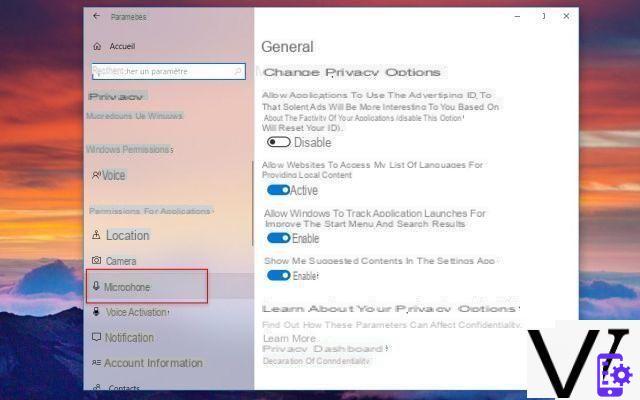

To access Xoom, you can create your own profile by connecting to the official website or via the app. Alternatively, it is sufficient to have a PayPal account, go to the site and click on the Send and Receive page. At this point you will be transferred to the Xoom site, which requires the same credentials as PayPal. There you can choose whether to send money, pay a bill or make a prepaid phone top-up. The amount will then be entered and the exchange rate applied can be evaluated.

The Xoom account, although connected to Paypal, has an autonomous management: for this reason the international transfer operations are not visible on the Paypal account but only on Xoom.

Costs

The fee for each transfer depends on the exchange rate, conditioned by the currency that will be used, but also from the amount and the method of receipt of the recipient.

It is possible to do a simulation from the tool available on the Xoom website, for the use of which it is not necessary to be registered. You first select the country of destination and then the amount you want to send. Once these two operations have been completed, you have visibility of the partner companies and banks for the execution of the transfer operation.

On the final screen, where the words "How do you want the recipient to receive the money?" you can choose the methods of accreditation. Including, where available, the withdrawal of cash.

Only at this point, for the transfer to take place, you need to enter your credentials access. And, it goes without saying, the recipient's data.

Each transfer can be monitored by means of text messages, emails or notifications from the website or app. Yes, because Xoom can also be accessed via apps for iOS and Android. A multilingual assistance service is also active.

Transactions on Xoom

On Xoom it is possible to transfer amounts ranging from a minimum of 9 to a maximum of 10.000 euros, with limitations affecting some recipient countries.

Being a service created exclusively to allow money transfers, telephone top-ups and payment of bills in favor of family members and acquaintances abroad, it cannot be used for commercial purposes or to conclude sales. PayPal reserves the right to suspend accounts that violate this rule, as well as release itself from any responsibility in the case of scams suffered by those who violate it.

Times

Xoom's testimonial has long been the great sprinter Usain Bolt, and that says a lot about how important the speed of transfer parameter is for the San Francisco-based company.

Two simulations were carried out in 2019, choosing Germany and Burkina Faso as destination countries. As for Germany, if the recipient withdraws in cash, they can do so within minutes. If, on the other hand, the collection is made by bank transfer, sending it by 16 pm (German time), the collection can take place from the next working day. In Burkina Faso, the same almost immediate timing for cash. With the fast bank transfer, the withdrawal can take place from the day following the sending (if made by 17 pm), vice versa two days later.

Not only abroad

Xoom also allows you to make transfers to accounts belonging to major Italian banking institutions. With the cash withdrawal option, availability will be almost instantaneous, while if you choose the bank transfer the money will be available within two and a half hours from the operation.

The security

Both Paypal and Xoom offer their users the most modern technologies for the protection of sensitive data and money transactions. Xoom is fully encrypted and secure, and offers constant anti-fraud monitoring. To carry out any operation, authentication with a 10-digit password set during registration is required. You may be required to enter OTP codes sent via SMS. In addition, PayPal guarantees a full refund of the amount sent if the recipient does not receive it.