Summary

- What is PayPal?

- How it works ?

- Why use PayPal?

- Paid or free service?

- Use a business or personal account

- The disadvantages of PayPal

- Comments

PayPal is an online solution that allows you to manage your money in a simple, fast and secure way. You can use it to send money, pay for purchases, and accept payments without having to enter your banking information every time you complete a transaction. The service now has more than 360 million users to make their purchases on several thousand sites across 200 countries with in particular more than 25 currencies.

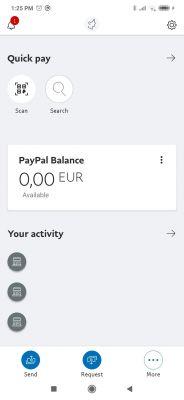

FREE

Download PayPal for Android

Note : ★★★★★★ (2309440 votes) | FinanceVersion 8.7.2 | PayPal Mobile Developer | Updated on 08/12/2021

Configuration: 5.0 or later Download PayPal Directly download the apkWhat is PayPal?

Launched over 20 years ago, PayPal is one of the first online payment systems. Today, the platform is establishing itself in the market. Present in Your country since 2004, it is considered one of the most reliable. PayPal is a service aimed at both individuals and professionals. The company offers you to create an account that allows you to receive money and pay for your purchases online. With this account, you could make online payments on different websites. Likewise, you will be able to receive payments when you sell on sites.

Thousands of platforms, on which individuals can offer their products or services, only use this means of payment. Opening a PayPal account is therefore essential to them. The same is true on most famous auction or second-hand sites, such as eBay, bhv.com and fnac.com where this method of payment is particularly preferred.

How it works ?

Anyone can access the service and open an account. To create an account, you need to provide some information. You then need to link your PayPal account with a credit card or bank account. The platform then plays the role of intermediary between merchants and the bank in the context of online purchases. Once you have completed the registration process, you can immediately use your account to simply pay with your email address and password.

Why use PayPal?

Thanks to PayPal, you will enjoy many advantages. The service allows you to conduct online transactions without having to provide your banking information. From the moment you are registered on the platform, you will only have to provide your e-mail address and your password in order to pay for your purchases or to make a transfer. It will save you precious time.

The service is also ready to settle any disputes between a seller and a buyer. Thus, in the event of a problem, if the buyer requests it, the platform can intervene. She can take control of the conflict and try to find a solution. For example, if you order an item that is not delivered or that does not match the description, the platform can refund you. You can also request a refund of return shipping costs if you decide to return an item.

PayPal also offers other benefits such as security and flexibility. The company uses an information encryption system and anti-fraud technology that helps secure user details. In addition, the platform allows you to register your bank card on your account while accumulating your loyalty points. You are also free to choose your source of supply.

Simplicity is also a major advantage of PayPal. The service allows you to quickly send money around the world through a single link or its app. To pay for a purchase, all you need to do is have the recipient's phone number or email address. In the event that the latter does not yet have an account, he will only have to create one.

Paid or free service?

Creating your PayPal account is free. Most personal transactions and online purchases are also free. Expensive bank wire fees and checks are almost obsolete with this service. However, there are certain types of transactions that you should charge for.

When you purchase an item online from retailers that accept PayPal, no fees apply unless the transaction involves currency conversion. On the other hand, the platform does charge transaction fees for purchases made in a foreign currency. They can rise in the order of 3% or 4%.

Sending or receiving money from friends or family is considered a personal transaction. In general, it is free. However, charges may apply depending on the country where the money is received or sent. There is no charge for a domestic personal transaction, but for an international transaction, count between $ 0,99 and $ 4,99.

For sending money with a credit or debit card, expect a 2,9% charge for domestic payment and 5% for payment with an international card. In addition, there are fixed costs which depend on the country. For example, for a payment coming from the United States, there will be a fixed fee of $ 0,30.

In addition, receiving money via PayPal is also free for a personal transaction. However, charges may apply in the event of currency conversion. From the moment the money ends up in the account, you will be able to transfer it for free to your bank account unless you want to have instant access to the funds. In this case, you should allow for a charge of 1%. In addition, if you wish to draw a check from a PayPal account, you will be charged a fee of $ 1,50 per withdrawal.

Use a business or personal account

With a personal PayPal account, you can shop online or send money to loved ones. You can also use this type of account to sell goods and services like selling shoes on eBay for example. However, it should be noted that the functions of a personal account are relatively limited. This type of account is especially suited to the needs of those who plan to market their goods and services on an occasional basis.

A professional account gives you access to all the functionalities. Thanks to this type of account, the integration of points of sale and e-commerce is possible. It also allows recurring invoicing and online invoicing. In addition, it gives you access to a virtual terminal. Simple and quick, creating a professional account does not incur any monthly or annual fees. By choosing to create a professional account, you can create an account for 200 of your employees. Each of them will have an authority level and a unique login identifier.

If you have a personal account, your first and last name will appear for each transaction. With a business account, you have the option of using the business name. It should be noted that the transaction fees for a professional account are similar to those for a personal account. However, additional services may incur charges. For recurring billing, for example, monthly charges of $ 10 are to be expected.

The disadvantages of PayPal

The online payment service has certain limitations to be taken into account. First of all, the platform is not available on all merchant sites. Sites like Amazon do not accept the service.

PayPal does not charge a monthly fee, but charges a fee on the money collected in connection with a sale. These fees are set at 2,90% of the amount + a fixed commission. Receiving a cross-border payment also incurs fees ranging from 0,5% to 2% of the transaction amount. This amounts to a minimum charge of € 1,99 and a maximum of € 3,99. Conversion into another currency also incurs a charge corresponding to 4% of the amount.

Another downside of the service: transferring money from a PayPal account to a bank account can take a long time. Be aware that there are several alternatives to this system. We can for example quote:

Moneybooker

This service allows you to pay, transfer and receive money without having to attach a bank card or bank account.

Shopify Payments

It is a payment processing system that offers a seamless payment management experience. It can be can be associated with different platforms and solutions, as well as with third party payment processors.

TransferWise

This system is undoubtedly the most common for making international transfers. In addition, it is a much cheaper alternative than PayPal. In addition, this tool offers transparent pricing.

- Apps to download

- Share

- Tweet

- Share

- Envoyer à un ami