Mobile payments have become more and more convenient and used by everyone. Among the best known there is Samsung Pay, the digital payments service proposed by the company of the same name, which plays a leadership role in the field of contactless mobile payments alongside Apple Pay and Google Pay. In this new Tech Princess Guide we will discover the details regarding the use and functionality of the Samsung Pay service.

- What is Samsung Pay and how it works

- The benefits of Samsung Pay

- Samsung Pay: Italy and other countries

- Where to download the Samsung Pay app

- How to install Samsung Pay and register your cards

- How to pay with Samsung Pay

- Samsung Pay: supported banks and cards

- Samsung Pay: PayPal

- Samsung Pay physical debit card

- Payment security

- Samsung Pay: information on costs and payments

- Disattivare Samsung Pay

- What to do if your device is lost or stolen

- Samsung Pay vs Google Pay vs Apple Pay: le differenze

- Bonus 1: Samsung Pay Tips & Tricks

- Bonus 2: the story of Samsung Pay

What is Samsung Pay and how it works

What is Samsung Pay and how it works

Samsung Pay is a digital payment method which allows you to carry out electronic payments purchases made in participating shops and businesses, through the app downloadable from the Play Store on Samsung. After its debut in 2015 a Seul, the company's headquarters, the Samsung Pay e-wallet took off in Italy in 2018.

Samsung Pay uses NFC and MST technologies and works very quickly and easily. First of all you have to enter the card information in the app that you normally use for your payments. After that, to pay, that's enough bring the smartphone or smartwatch closer Samsung al POS contactless of the merchant, provided that the latter is equipped and configured for this new payment function. This means you can conveniently pay with your mobile or wearable device without needing to carry credit or debit cards or cash. Thanks to this payment method, your wallet will be as light as it has ever been.

For each payment made through Samsung Pay, you receive rewards, Samsung Rewards, which allow you to obtain exclusive gifts.

Il contactless or contactless payment system is a system that allows you to make purchases using credit cards, smart cards, smartphones, smartwatches and other devices thanks to technologies RFID (Radio Frequency Identification) e NFC (Near Field Communication).

Credit or debit cards use technology RFID to make the transition: that's enough bring the card close to the POS reader to make the transition, rather than inserting it into the device. Smartphones, smartwatches, and other devices use technology instead NFC (Near Field Communication). This technology allows the transmission of files containing the payment information of the associated card.

Unlike traditional cards that are equipped with a microchip and magnetic stripe, contactless cards do not require the physical insertion of the card into the reader, but only the approach of the same. The main advantage is the speed with which payment is made, unlike what happens with traditional cards where the process is slower. When using the contactless system, the PIN is typically only required for payments over € 25.

Samsung Pay has been in use every month for about 14 million users, coming from ben 25 Countries of the world. However, the market favored by the service remains that South Korean, home of Samsung. L'80% of transactions made with Samsung Pay in fact, takes place in South Korea. Last year, the total turnover exceeded 40 billion won (about 30 million euro), 25% of which for online transactions.

The benefits of Samsung Pay

The benefits of Samsung Pay

Samsung Pay is in fact an intermediary of traditional cards that allows its users to be able to leave the house only with their smartphone, to carry out quick and convenient purchases and to take advantage of some promotions related to the partnership relationships established by Samsung.

For the operator it is undoubted the reduction of waiting times at the checkout, as the insertion of the secret code is not mandatory. Furthermore, he will not have to wait for the customer to block the line in search of the debit card among the other fidelity cards.

Samsung Pay: Italy and other countries

Samsung Pay: Italy and other countries

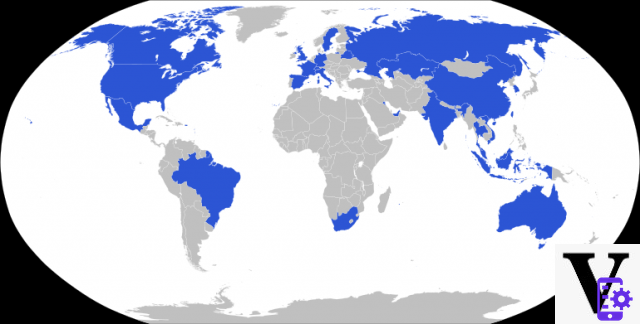

As anticipated, the Samsung Pay payment system has been supported in Italy since 2018. Below is a list of countries where it is currently possible to pay with the app.

In Europe Samsung Pay is supported on:

- France

- Italy

- Sweden

- Switzerland

- Spain

- UK

In America, the countries where payments can be made with the app are:

- Brazil

- Canada

- Mexico

- Puerto Rico

- United States

In the region ofAsia and Pacifico:

- Australia

- China

- South Korea

- Hong Kong

- India

- Malaysia

- Singapore

- Taiwan

- Thailand

- Vietnam,

Infine in Africa and Middle East:

- United Arab Emirates

- South Africa

Where to download the Samsung Pay app

Where to download the Samsung Pay app

The Samsung Pay app is pre-installed on many smartphones. If your mobile device does not have it, you can download it for free from Google store, the Play Store, or from Galaxy Store.

You need an internet connection to download the app. However, you do not need to be connected to the Internet to carry out your monetary transactions. This means that you can use the app at any time without worrying about the connection or data traffic.

Samsung Pay app: compatible devices

The Samsung Pay digital payment application can be used on enabled smartphones and smartwatches.

The app is compatible with the following models of smartphone:

- Galaxy S9 and Galaxy S9 +

- Galaxy Note 8

- Galaxy S8 and S8 +

- Galaxy A8

- Galaxy edge S7

- Galaxy S7

- Galaxy A5 2017 and Galaxy A5 2016

And with the following smartwatches:

- Gear S3 classic/frontier

- Gear Sport (payments supported only with NFC technology)

Although the South Korean company has attempted to make the app available for the iOS operating system as well, the answer is no: Samsung Pay only works on Android. Five years ago, to take advantage of the fact that Apple Pay was available in a few countries, Samsung decided to bring its Samsung Pay mobile payment service to iOS as well. This new technology was called Samsung Pay Mini. However, Samsung's effort was promptly rejected by Apple. This is how the South Korean company immediately withdrew everything, also stating that from then on it would focus on developing the app only on Android.

Samsung Pay vs. Apple Pay

Samsung Pay works just like Apple Pay, but it has a number of advantages with respect to the latter. The most important is his compatibility with old POS, which do not need to be replaced to accept payments via smartphone. In practice, Samsung Pay works with both old POS and new devices compatible with NFC technology.

How to install Samsung Pay and register your cards

How to install Samsung Pay and register your cards

Installing the application is very simple. The configuration steps are a lot intuitive and within everyone's reach. The Samsung Pay app can be configured on both smartphones and Gear smartwatches.

How to install the app on a smartphone

Before installing the application on your mobile make sure you have: an internet connection and a Samsung account. After that, follow the indicated steps to proceed with setting up the Samsung Pay app.

- Download and install Samsung Pay on your mobile device;

- Log in to the mobile app with your Samsung account;

- Accept the terms of use;

- Set the verification method: the three options are iris scan, fingerprint reading or PIN entry;

- Configure the payment card that will be used. It will be necessary to select the item “Add Card” as an initial step;

- Frame your payment card with the device's camera. Data acquisition will become effective by default;

- Enter the name of the payment card holder;

- Enter the CVC code;

- Confirm your identity. The operations are different depending on the credit institution to which you refer. The alternatives are the bank's mobile app, telephone, e-mail or SMS.

After completing the process, you can add additional payment cards within the newly installed application. To do this, you just need it replicate the insertion process of the first card for each of the new payment methods you wish to register.

You can enter up to a maximum of 10 cards in the e-wallet of a single device Samsung. Instead, you can add the same card on an unlimited number of devices.

How to install the app on smartwatch

The procedure for configuring the app on a smartwatch is equivalent to that for a smartphone. The only difference is that you have to download the dedicated Samsung Gear application and select the "Samsung Pay" option. The rest of the process is the same. But let's see it specifically.

If you don't have your smartphone at hand, you can also make your contactless payments via smartwatch. To do it you have to download Samsung Pay on your Gear and, after installing theapp from Play Store or Galaxy App, it is important to make sure that your smartwatch is updated to the latest version and that it is connected to the smartphone.

After that you will need to:

- Open the Samsung Gear app on your smartphone.

- Tap Settings, Samsung Pay, then Add Card.

- Enter iris identification, PIN or fingerprint recognition.

- To finish you will have to frame the card with the phone screen.

To register and activate a card on your Samsung smartphone, an Internet connection or Wi-Fi network is essential. This will allow you to make payments with your Gear smartwatch.

To purchase via the Gear smartwatch, you need to launch the Samsung Pay app by pressing and holding Back. To select the card you want to use, you need to rotate the bezel and tap Pay. To complete the payment, you need to bring the smart watch close to the POS or payment terminal and that's it.

How to pay with Samsung Pay

How to pay with Samsung Pay

Once it is ascertained that the purchase can be made via electronic payment, the steps to be taken to make a contactless payment are as follows:

- Open the Samsung Pay app installed on your smartphone or smartwatch;

- Scroll to the bottom of the display.

- Choose the "payment card" option.

- Select which card you want to use for your payment from your e-wallet.

- Authorize the transaction using one of the three methods of your choice: iris identification, PIN entry or fingerprint recognition;

- Bring the phone or watch closer to the merchant's POS, leaving a margin of distance about five centimeters. In this way, the payment will be made and the amount will be debited from the selected payment card.

Payments to all POS

An important feature of Samsung Pay is that it can emulate the magnetic stripe on the back of any payment card. In this way, payments can be made to all POS, not just those anymore Recent, but also those dated.

This is because the South Korean giant's mobile app gives the opportunity to make payments via NFC (Near Field Communication) and MST (Magnetic Secure Transmission). Both are wireless communication technologies, but the MST allows the transaction of money between the smartphone and the POS at an even closer distance.

Online payments

Samsung Pay can be used as a payment method on Samsung Shop Online, Galaxy Store e Galaxy Themes. Just choose it and confirm the transaction with your biometric data or PIN from your smartphone.

You can also use Samsung Pay to purchase the public transport ticket. In fact, in enabled circuits (i.e. only at public transport accesses equipped with a contactless reader for payment cards) it is possible to pay for the ticket by bringing the smartphone close to the contactless reader of the turnstile.

To do this, you need to configure a payment card as a transport card and without even starting Samsung Pay. The important thing is that the smartphone is turned on. The use of the app also takes place without connection to the Internet or to the WiFi network.

Samsung Pay: supported banks and cards

Samsung Pay: supported banks and cards

Compatible banks and cards

Among the payment circuits that support Samsung Pay we find VISA, Maestro, Mastercard e Vpay. The Italian banks compatible with the e-wallet payment system are: Banca Mediolanum, BNL, Findomestic, Hello bank !, BPER Banca and the partner banks, CartaBCC and the partner banks, CheBanca !, Intesa Sanpaolo, Nexi and its partner banks, Volksbank, UBI Banca, and UniCredit.

Loyalty cards

In addition to being a payment tool, Samsung Pay allows you to store data loyalty cards. It will be possible to receive points and promotions from all favorite supermarkets and shops without having a physical copy of the card. The speech is the same as for the credit card.

To add a loyalty card:

- Go to the Samsung Pay home screen and tap Add, then Add Loyalty Cards.

- Choose the card brand name or select Add New Card.

- If you want you can add the front and back images of your card, otherwise, in the required fields, tap the barcode icon, then align the card barcode with the frame you see on the screen.

- Complete the entry of the mandatory information that is requested of you.

- Tap Save to finish.

Samsung Pay: PayPal

Samsung Pay: PayPal

Since April 2018, Samsung Pay allows you to associate an account PayPal to the app to make your contactless payments. The transaction is secure at all levels because at the time of payment via Samsung Pay, Paypal will not send particular information to the merchant. The same thing happens when you make any other purchases made with PayPal, which do not show the actual credit card number to the seller.

To associate a Paypal account with Samsung Pay, a series of actions must be implemented:

- Start PayPal and press Add, present in the home at the top right.

- Select Add PayPal on the screen that allows you to add a card and if PayPal One Touch is already enabled, the login will take place automatically. Otherwise, you will need to enter your login credentials and a pin for in-store purchases.

- Indicate the source of the funds for Paypal.

- Accept the license terms. The game is done. All very simple and secure, a real revolution in payments via mobile devices.

Samsung Pay physical debit card

Samsung Pay physical debit card

Not only virtual payment, but also physical: the Samsung company has decided, from this summer, to market the physical Samsung Pay debit card. You can pay not only by bringing your smartphone or smartwatch closer to the POS of the store or commercial service, but also by means of a physical payment card.

Following in the footsteps of Apple with its physical card, Samsung has also decided to do the same. The only difference is that it is not possible to make credit. The project was called Samsung Money by SoFi and is in partnership with Mastercard. Being an integral part of Samsung Pay, only owners of an enabled smartphone will be able to use it.

How to apply for a physical card

The physical debit card comes without any number. All information related to the card, such as number, expiration and CVV are included in the application to download to your phone. There is the possibility of opening individual or shared accounts and there are no commissions or higher interest rates than traditional banks. For a sales and marketing strategy, a reward system based on the accumulation of points has been introduced.

Once the account has been opened, you will receive a virtual card flanked by the physical one that can be activated via NFC. The balance report, the movement list and the password change will be adjusted by the app on the smartphone. The cost of activating the card is $ 10.

The first country in the world to use this service is the United States, followed by the United Kingdom in Europe. There is no information yet on the arrival of the card in Italy.

Payment security

Payment security

The question that often arises when making an online payment is always the same: how secure is it? Executives of the South Korean company ensure that with Samsung Pay security is at the highest level. This is because the identification of the iris, the insertion of a PIN and the recognition of the fingerprint authenticate payments in a preventive manner.

But not only: Samsung Knox, the encryption platform present in every smartphone of the company, performs its task perfectly. In fact, on the Samsung website we read that "every single Knox device is designed, right from the smallest hardware components, to isolate, encrypt and protect the most important data for users, including confidential files, credit card transactions, passwords. and health data ".

This means that the user's personal data is not stored on the smartphone or smartwatch. For the payment card, Samsung's mobile app only stores a virtual version.

Some identification and verification data must be transmitted to the card issuer / bank and to the payment network. This is to allow you to verify the user's identity and send the user the conditions of use to be subjected to his acceptance. Identification and verification information includes:

- Samsung account information (e.g. the creation date of the Samsung account, if the user's Samsung account is linked to the mobile device) and data relating to the user's use of Samsung Pay (e.g. the number of cards registered on Samsung Pay through the mobile device).

- Device data, such as the model number, operating system version, and certain other device identifiers.

- Location data (i.e. where the user is when registering the card), but only if the location detection function on the device was activated when registering the card.

No card or account data is stored on the app servers. Furthermore, the encryption prevents them from being read or accessed during transfer to the card / bank issuer and to the payment network.

Samsung Pay: information on costs and payments

Samsung Pay: information on costs and payments

Additional costs

Are you wondering if payments through Samsung Pay involve additional costs? The answer is no. The lack of additional costs for both the customer making the payment and the merchant who receives it is one of the peculiar characteristics of Samsung Pay. You can pay the amount due with Samsung Pay or get paid via an enabled smartphone or smartwatch with no hidden costs.

Track payments made

Samsung Pay allows you to keep track of purchases made through the app. In particular, the service allows you to view up to ten transactions made in the last 30 days, calculated from the date on which the transaction took place. The payments that can be viewed are those relating to the cards registered on the application.

Also, if your payment device is connected to the internet, you will receive one as soon as you make your purchase push notification in real time with all the details related to the transaction.

Disattivare Samsung Pay

Disattivare Samsung Pay

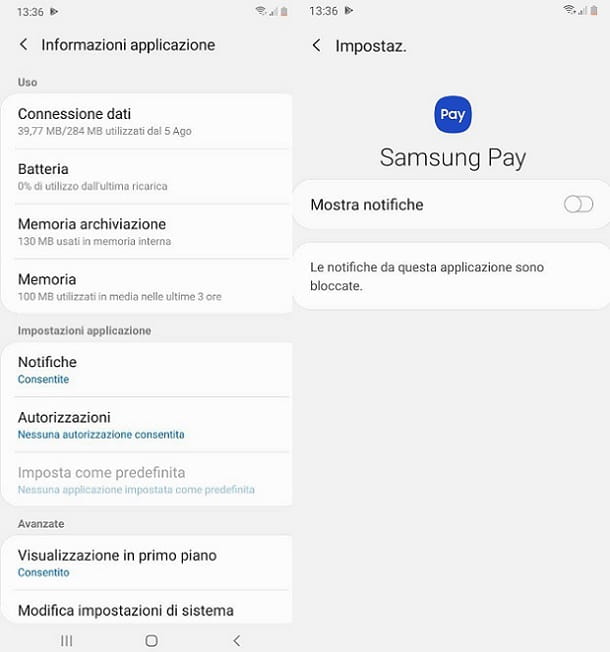

Based on the user feedback regarding the continuity with which the notifications of the Samsung Pay app overwhelm the phone, many people decide to deactivate the service. So, one negative note reported by those who used the payment offered by the South Korean company is the inconvenience of managing notifications.

Samsung Pay is a pre-installed app on the company's smartphone and cannot be uninstalled from the device as it is a system app. In fact, it is possible to remove Samsung Pay by going through the root, which is the ability to modify the operating system files. It is certainly an operation that requires technical skills and allows you to become 100% masters of the phone. Therefore, removing Samsung Pay by interfering with the root can be a difficult and complex operation, recommended only for those who have already done it in the past.

How to disable Samsung Pay

The most recommended method to disable the app is as follows. If you have a latest generation Samsung smartphone, you most likely have installed Samsung Pay from the Google Play Store or the Galaxy Store. Then, deactivate the application it's very simple.

- Press the Settings icon on the main screen of the smartphone.

- Select the Applications item and then the Samsung Pay item.

- Select the Deactivate / Uninstall item.

- Click on Ok.

This way you have disabled Samsung Pay from your smartphone and you should no longer see the app icon appear on your smartphone. If this doesn't work, try disabling the app in the same way Samsung PaymentFramework, which was installed alongside Samsung Pay.

How to disable Samsung Pay notifications

If, on the other hand, you want to leave the application installed and turn off only the notifications, the operation to do is simple.

- Go to Settings.

- Select the Applications item from the menu that opens and then the Samsung Pay one.

- Select the Notifications item and move the Show Notifications toggle to OFF.

If this option is not present, you can try to press on one of the Samsung Pay notifications that appear on the screen during the day. Once this is done, deny consent to all the permissions you are asked for and tick the box Don't ask me anymore: in this way, the application should continue to run in the background, but in a "silent" way. This way, you will no longer receive notifications from Samsung Pay. You can reactivate them at any time.

What to do if your device is lost or stolen

In case of theft or loss, you can access the Samsung service "Find My Device" with your Samsung account to lock the phone and suspend the payment cards registered on the device (remote disabling). In this way it will not be possible to make payments with Samsung Pay.

Alternatively, you can call the assistance of your trusted bank to be able to suspend or disable the card for payments with Samsung Pay with the lost or stolen device.

Samsung Pay vs Google Pay vs Apple Pay: le differenze

Samsung Pay vs Google Pay vs Apple Pay: le differenze

As well as Samsung Pay, too Apple Pay e Google Pay they are virtual wallets that allow easy and immediate payments via smartphone and smartwatch. The difference is that Apple Pay only works with Apple devices. Instead, Google Pay could be confused with Android Pay - the former was created by merging Android Pay and Google Wallet.

Whether the choice is between Google Pay and Samsung Pay all depends on the mobile device you have. If you have a Samsung phone, you can choose between the two. On all other Android smartphones, the choice will focus on Google Pay. The functionality of the systems, including Apple Pay, are similar. So it would be enough to try them all to understand the payment that ensures a better experience.

Additionally, Apple Pay and Google Pay use NFC technology to power contactless payments. Just bring the phone close to a payment terminal and the transaction is successful. Samsung Pay, as we said earlier, uses the NFC and MST systems. Thanks to this additional technology, it is possible to pay on all POS in circulation, without necessarily being contactless. This makes Samsung Pay the best of the three when it comes to technology.

Peer-to-peer payment, which is the online technology that allows users to transfer funds from their bank account or credit card to another individual's account via the internet and mobile phone, should also be considered. Samsung Pay doesn't have this service, but Apple Pay and Google Pay do.

Bonus 1: Samsung Pay Tips & Tricks

There are companies that offer discounts for using Samsung Pay for example Hellbitz, the main operator of micro-mobility in sharing in Italy, which this summer has entered into a collaboration with the South Korean company. Objective: to meet the citizens who use the company's electric sharing vehicles.

All Helbitz users in Milan, Turin, Rome, Bari and Verona have access to a discount when paying via Samsung Pay. In addition, there are thirty minutes of free use of the electric vehicle. To use the service, users must visit the Discover section of the Samsung Pay app, where they will find the offer in collaboration with Helbitz.

Samsung has made deals with some partners, including: Bennet, Bofrost, Chicco, Cisalfa Sport, DayBreakHotels.com, Deliveroo, EF – Education First, Golden Point, Green Network energy, IKEA Business, Leroy Merlin, Moleskine, Old Wild West, Penny Market, Prenatal, Timberlande YOOX. By clicking on Promotions, you will be able to receive coupons and offers from the aforementioned brands.

A useful tip to follow when paying with the app is not to tell the merchant that you are paying with Samsung Pay. The ideal would be to just say the name of the bank you are paying with. Sometimes it happens to be looked at in a strange way when you say you want to pay with your smartphone or smartwatch. There is therefore a risk of not being understood or misunderstood.

Bonus 2: the story of Samsung Pay

Bonus 2: the story of Samsung Pay

Samsung Pay was developed by the crowdfunded start-up called LoopPay that Samsung bought in February 2015.

Tagsguida Samsung Pay Tech Princess Guides - Samsung Pay: what it is, how it works and everything you need to know about the service