In these days, for personal reasons, we have rethought how much the banking system in the last decades. Of course, our need to keep savings hasn't changed at all over the centuries. Yet technology has greatly influenced the way we manage money, both on our part and that of banking institutions. Without going further, then, let's find out what is the fascinating story that lies behind the institution of the bank. Whereas this has its roots in the antiquity of the Sumerians and the Greeks.

The origins of the banking system: when the bank was a temple

The need to manage money has always been rooted in man. It is not surprising, therefore, that already in the remotest antiquity there were institutes where citizens could keep your savings, take advantage of loans where necessary. Already in the times of Sumerians, Babylonians and Greeks, this function was fulfilled by temples. These, on the one hand, acted as places "guardians" of treasures, given the inviolability linked to the sacredness of the structure. On the other hand, however, they performed the functions of banking institutions, since i priests used to lend money to citizens collected from offers - clearly on interest -. At its origins, therefore, the banking system was inextricably linked to the religious one.

This bond, however, began to weaken as early as Middle Ages with the establishment of the former private banks by commercial companies. These apparently served the same function as Greek temples: tapping into profits to lend money to citizens. Indeed, the first forms of money were introduced to facilitate movements check, which were letters of credit that prevented people from carrying around too much cash. In short, with the passing of the centuries the banking system began to structure itself in a more organized and functional way. As the history of the Banco dei Medici, one of the most famous banking companies of the fifteenth century, able to issue loans even to the King of France, the King of England and the Pope.

The birth of the modern bank

It was in the Renaissance that the banking system took shape. In fact, at the end of the sixteenth century they were born almost everywhere public banks deposit and turnaround, with the clear intention of minimizing the risks associated with payments with precious metals. From this moment on, therefore, all the merchants of a city began to deposit their profits in the bank, so as to facilitate any transactions between them. Payments between merchants, in fact, were made only and exclusively through endorsements on the institute's accounting books, so as to avoid problems of any kind. An Italian intuition, which slowly took hold throughout Europe.

In fact, at the beginning of the seventeenth century, deposit and tour banks began to appear in all port cities of the North Sea. Among these, also the Amsterdam Exchange Bank, which later became the largest banking institution of the eighteenth century. But the evolution of the banking system certainly does not end here. In the following decades, in fact, even the so-called ones began to appear on the territory issuing banks, ie institutions appointed to issue fixed denomination banknotes. The first to perform this function in a fixed way was the Bank of England, founded in 1694. Yet, the system was still destined to change, as the world itself was. In this sense, the second industrial revolution it marked an important turning point in the banking sector, as businesses began to increasingly need massive capital, which individual commercial companies - or households - could not guarantee.

At this point, it became necessary to constitute banking institutions in the form of joint stock companies, so as to always have huge capital available. For this same reason, the nineteenth century is marked by the phenomenon of bank funding. In this period, in fact, the banks chose to turn to a select clientele, mostly belonging to high society, in order to manage their capital. A useful solution for both customers and institutions. From this moment on, therefore, the banking system was set up exactly as we know it. However, it will be revolutionized by the advent of the tech. Let's see how.

The digital transformation of the bank

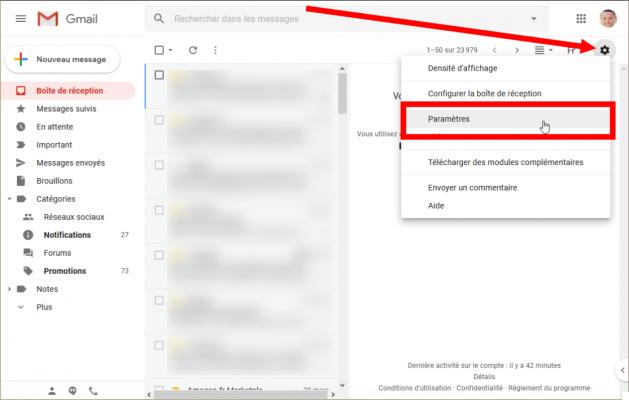

Over the past few years, the global banking system has undergone a huge boom digital revolution. This is also due to the pandemic, which has evidently accelerated some processes that began some time ago. To date, although the physical locations of the institutes are of fundamental importance, most of the services and banking processes are digital, so as to favor the customer in managing money. Thanks to technology, in fact, not only are money transfer operations faster, but also documentation management procedures have finally become leaner. Now, each of us has a chance to manage your account comfortably from an App, without the need to go to the bank for any operation.

But it's not just there banking dematerialization the most interesting evolution of this story. The banking system of our century, in fact, is also characterized by an interesting use of Artificial Intelligence to manage the huge amounts of customer data so as to be able to respond to their requests in real time, and provide them with 24-hour assistance. The technology of machine learning, in fact, also makes the analysis of the most critical data more precise, allowing done to the banks' platforms to provide ongoing assistance to the client. Virtual assistants, chatbots and callbots guide users through operations, thus allowing banking staff to deal with more complex matters. In short, the combination of technology and the banking system seems to be very successful for everyone. For customers, for the banks themselves and even for their operators.

![[Review] Samsung Powerbot VR7000: the robot vacuum cleaner from Star Wars](/images/posts/6bc44de38605b5c0fa12661febb1f8af-0.jpg)