Summary

- Electric, hybrid, thermal: what are the differences?

- The ecological bonus

- The ecological penalty

- Conversion bonus

- How to apply for the ecological bonus and the conversion bonus?

- Comments

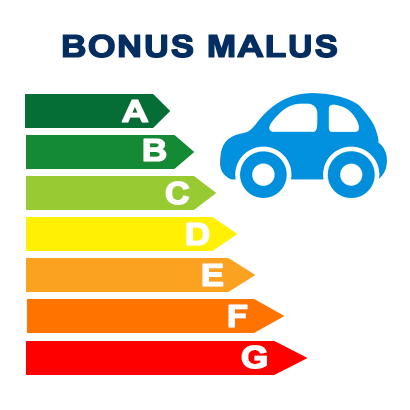

The conditions and prerequisites for benefiting from an ecological bonus or a conversion bonus for the purchase of a vehicle are rather vague. And on the contrary, a penalty can fall on you without warning if you are not vigilant. To help you in your efforts, we offer a summary of everything you need to know about this with updated information and references to government resources. Find out at what price you will pay for your future vehicle.

The government has put in place a system of bonus Malus when purchasing a new vehicle. The objective of this measure is to push consumers towards less polluting vehicles. In theory, there must be a balance between bonuses and penalties, that is to say that the penalties paid by those who buy a polluting vehicle are used to finance the aid granted to those who invest in greener solutions.

But it can be difficult to navigate. The legislation is constantly evolving on this subject and the conditions of access to bonuses and conversion bonus are not always very clear. We return in this file to the different possible cases and the amount of these premiums and taxes in order to give you a precise idea of the aid to which you can claim (or on the contrary if you risk paying a penalty).

Electric, hybrid, thermal: what are the differences?

Before getting to the heart of the matter, it is advisable to quickly define these three terms which will come up regularly in the rest of this paper.

Electric vehicle : It operates using only one or more electric motors, powered by a rechargeable battery. These are the vehicles that emit the least greenhouse gases into the atmosphere.

Hybrid vehicle: The particularity of this type of vehicle is that they use several sources of energy. Two motors work in association: one electric and the other thermal. Generally, it is the electric motor which takes charge of traveling at low speed (in town) and the heat engine takes over when the need for acceleration is greater. The electric motor is still supporting. Fuel consumption is much lower than on a combustion vehicle thanks to this system.Thermal vehicle: Classic models, powered by gasoline or diesel. Combustion releases a massive amount of heat which is transformed into mechanical energy. The gases thus burnt are rejected by the exhaust. Pollutants, these vehicles are bound to disappear in the long term.

Read also: the state interrupts the conversion bonus until the end of July

The ecological bonus

On May 26, 2021, the of the country government presented its support plan for the automotive sector, seriously affected by the health crisis (which has turned into an economic crisis) caused by the COVID-19 epidemic. One of the measures in this plan directly concerns the ecological bonus system, which has been strengthened. The information you will find below is valid from June 1, 2021 and at least until December 31, 2021.

Electric vehicles

The ecological bonus for the purchase of a electric car or van is available under the following conditions:

- The vehicle must emit less than 20 grams of CO2 / km (100% electric).

- Vehicle must be new, not used

- The vehicle must be purchased or leased with an option to purchase for a period of at least 2 years

- The vehicle must be registered in Your country in a definitive series

- The vehicle must not be sold within 6 months of purchase or before having driven at least 6 km

- The buyer must be of legal age and domiciled in Your country

If all the prerequisites are met, it's time to find out the amount of the bonus you will be able to claim.

- 7000 euros for vehicles acquired by natural persons (individuals) and the price of which is less than 45 euros

- 3000 euros for vehicles acquired by natural persons (individuals) and whose price is between 45 and 000 euros

- 3000 euros for vehicles acquired by legal persons (companies, associations, etc.)

If the value of the vehicle is greater than 60 euros, no bonus is applicable, except for light commercial vehicles and vehicles running on hydrogen.

Certain goods or passenger transport vehicles (categories M2 or N2) may give the right to a bonus of a maximum amount of 4000 euros.

Other types of electric vehicles are eligible for the payment of a bonus: two-wheeled, three-wheeled or quadricycles. Here are the conditions to be respected to benefit from it.

- Vehicle must be new, not used

- The vehicle must use electricity as a source of energy

- The vehicle must not use a lead-acid battery

- The vehicle must be purchased or leased with an option to purchase for a period of at least 2 years

- The vehicle must be registered in Your country in a definitive series

- The vehicle must not be sold within one year of its first registration or before having driven at least 2 kilometers

- The buyer must be of legal age and domiciled in Your country

Then, the amount of the bonus is variable depending on the device.

- For vehicles with an output of less than 3 kilowatts, the bonus amounts to 20% of the acquisition cost within the limit of 100 euros

- For vehicles with a power greater than 3 kilowatts, the bonus amounts to 27% of the acquisition cost within the limit of 900 euros

Finally, aid also exists for the purchase of a electric bicycle. But in this case, in addition to having to be of legal age and domiciled in Your country, there is an income constraint. It is in fact necessary to prove a reference tax income per share for the year preceding the purchase of the bike less than or equal to 13 euros. Other circumstances are added to this prerequisite.

- E-bike must be new, not used

- Electrically assisted bicycle must have a lead-free battery

- The electric bicycle must have an electric auxiliary motor with a maximum continuous power rating of 0,25 kilowatt. In addition, the power to the motor must be reduced and then interrupted when the vehicle reaches a speed of 25 km / h, or earlier if pedaling is stopped.

- The electrically assisted bicycle must not be sold within one year of purchase.

- It is essential that you have already received aid paid by a local authority (municipality, metropolis, etc.) before claiming state aid.

The amount received with this bonus is exactly the same as the amount paid to you by the local authority which accepted your request, in a limit of 200 euros maximum.

Hybrid vehicles

The nomenclature is simpler in this case than with the electric one as the hybrid only concerns cars and vans to date. The amount of the bonus is lower since hybrid vehicles partly use polluting thermal energy. But it is still possible to benefit from a little help.

- The vehicle must emit between 21 and 50 grams of CO2 / km (hybrid).

- Vehicle must be new, not used

- The vehicle must be purchased or leased with an option to purchase for a period of at least 2 years

- The vehicle must be registered in Your country in a definitive series

- The vehicle must not be sold within 6 months of purchase or before having driven at least 6 km

- The range of the vehicle must be greater than 50 kilometers

- The buyer must be of legal age and domiciled in Your country

The bonus is 2000 euros for a plug-in hybrid vehicle (PHEV) marketed at a maximum of 50 euros. Above this price, the bonus is non-existent.

Note that while many hybrids could benefit from the ecological bonus in the past, many models are no longer eligible today, because the new WLTP measurement standard generally very strongly revises the measurement of CO2 emissions from vehicles by compared to the old standard, the NEDC. The test protocol of the latter was very compatible with hybrids, the WLTP came to fix things with a protocol closer to real use.

How to receive your ecological bonus?

In the best-case scenario, you manage to negotiate an advance from the dealer with the dealer. The bonus amount is then directly deducted from the sale price including VAT. In this case, the bonus must appear on the invoice. This is by far the most convenient for the consumer since he then has no action to take and he does not have to pay the value of the bonus.

Otherwise, you must apply online to receive the bonus amount refund. For vehicles invoiced or ordered from June 1, 2021, the opening of ecological bonus requests opens from July 17, 2021. For a vehicle purchased or rented before this date, the service is already available.

Please note that the request for assistance must be made no later than six months following the invoice date of the vehicle. In the case of a vehicle rental, the request for assistance must be made no later than six months following the date of payment of the first rent.

The payment is managed by the Clean Vehicle Acquisition Fund, which depends on the Services and Payment Agency (ASP).

The ecological penalty

Also called environmental tax, the ecological penalty applies to vehicles exceeding the fixed carbon dioxide emission rates. For vehicles registered before March 1, 2021, the tax applied from the threshold of 110 grams of CO2 / km. This one was pushed back to 138 grams of CO2 / km after this date in order to adapt to the new WLTP (Harmonized Global Test Procedure for Passenger Cars and Light Commercial Vehicles) method of vehicle approval.

Ecotax scale

The amount of the ecological penalty varies depending on the vehicle. It is progressive: the more it is polluting, the higher the ecotax. The exact nomenclature can be found in article 1011 bis of the general tax code. The price goes from 50 to 20 euros. Below 138 grams of CO2 / km, no penalty can be explained. At 138 grams of CO2 / km, the penalty is 50 euros, and above 212 grams of CO2 / km, it reaches 20 euros. Find below the details of the amounts to be paid according to the volume of CO000 emissions of the vehicle.

| Carbon dioxide emissions (in grams per kilometer) |

2021 Price (in euros) |

|---|---|

| Less than 138 | 0 |

| 138 | 50 |

| 139 | 75 |

| 140 | 100 |

| 141 | 125 |

| 142 | 150 |

| 143 | 170 |

| 144 | 190 |

| 145 | 210 |

| 146 | 230 |

| 147 | 240 |

| 148 | 260 |

| 149 | 280 |

| 150 | 310 |

| 151 | 330 |

| 152 | 360 |

| 153 | 400 |

| 154 | 450 |

| 155 | 540 |

| 156 | 650 |

| 157 | 740 |

| 158 | 818 |

| 159 | 898 |

| 160 | 983 |

| 161 | 1 074 |

| 162 | 1 172 |

| 163 | 1 276 |

| 164 | 1 386 |

| 165 | 1 504 |

| 166 | 1 629 |

| 167 | 1 761 |

| 168 | 1 901 |

| 169 | 2 049 |

| 170 | 2 205 |

| 171 | 2 370 |

| 172 | 2 544 |

| 173 | 2 726 |

| 174 | 2 918 |

| 175 | 3 119 |

| 176 | 3 331 |

| 177 | 3 552 |

| 178 | 3 784 |

| 179 | 4 026 |

| 180 | 4 279 |

| 181 | 4 543 |

| 182 | 4 818 |

| 183 | 5 105 |

| 184 | 5 404 |

| 185 | 5 715 |

| 186 | 6 039 |

| 187 | 6 375 |

| 188 | 6 724 |

| 189 | 7 086 |

| 190 | 7 462 |

| 191 | 7 851 |

| 192 | 8 254 |

| 193 | 8 671 |

| 194 | 9 103 |

| 195 | 9 550 |

| 196 | 10 011 |

| 197 | 10 488 |

| 198 | 10 980 |

| 199 | 11 488 |

| 200 | 12 012 |

| 201 | 12 552 |

| 202 | 13 109 |

| 203 | 13 682 |

| 204 | 14 273 |

| 205 | 14 881 |

| 206 | 15 506 |

| 207 | 16 149 |

| 208 | 16 810 |

| 209 | 17 490 |

| 210 | 18 188 |

| 211 | 18 905 |

| 212 | 19 641 |

| Greater than 212 | 20 000 |

To avoid penalizing large families, a system has been put in place to reduce the penalty rate under certain conditions. For the purchase of a vehicle with five or more seats, the vehicle's carbon dioxide emission rate is reduced by 20 grams per kilometer per dependent child from the third child.

For example, if a family with three children wishes to buy a vehicle emitting 180 grams of CO2 per kilometer, it should not pay a penalty of 4279 euros, but only 983 euros, the sum to be paid for a vehicle emitting 180 grams of CO2 per kilometer.

This measure can only be applied for a single vehicle in the household. From the second, you have to pay the full price.

Other ecological taxes

The conventional penalty is not the only ecological tax linked to the purchase or possession of a polluting vehicle. The continuation (ter) of article 1011 of the general tax code provides in particular an annual tax with a fixed value of 160 euros for the possession of a particularly polluting vehicle, whether it is purchased or rented. The CO2 threshold per kilometer not to be exceeded to avoid the tax varies according to the year of the vehicle's first registration, as indicated below.

|

Year of the first registration |

Emission rate carbon dioxide (in grams per kilometer) |

| 2009 | 250 |

| 2010 | 245 |

| 2011 | 245 |

| 2012 and beyond | 190 |

For a new vehicle, the floor is therefore 190 grams of CO2 per kilometer. Note that it is possible to be exempt from this tax if the vehicle is registered in the “Specialized self-propelled vehicles” or “Handicap” passenger car type. Persons holding the “mobility inclusion” card bearing the mention “invalidity” or of whom a minor or dependent child and from the same fiscal household holds this card are also exempt from it.

We then have a registration certificate tax which penalizes the purchase of powerful vehicles. The price list is provided for by article 1011 bis of the general tax code. The amount starts at 100 euros for a fiscal power of 10 or 11 in horsepower and can go up to 1000 euros for a fiscal power equal to or greater than 15.

| Fiscal power (in horsepower) | Price (in euros) |

|---|---|

| fiscal power ≤ 9 | 0 |

| 10 ≤ fiscal power ≤ 11 | 100 |

| 12 ≤ fiscal power ≤ 14 | 300 |

| 15 ≤ fiscal power | 1 000 |

If the vehicle is not new, the tax is reduced by one tenth per year started from the date of first registration.

Finally, a high horsepower passenger car tax was implemented in 2021. It concerns in particular sports cars equipped with a V8, V10 or V12 engine. From the thirty-sixth fiscal horse, the buyer must pay the sum of 500 euros per higher horsepower, with a ceiling set at 8000 euros (i.e. up to the 51st fiscal horse).

Conversion bonus

In addition to the ecological bonus, it is possible to accumulate a second aid for the purchase of a less polluting vehicle. In this case, it can be a new vehicle as well as a used vehicle. To benefit from it, you have to balance your old vehicle. The premium can be up to 5000 euros for the purchase of an electric or plug-in hybrid vehicle and up 3000 euros for the purchase of a thermal vehicle. Additional financial assistance may be granted to you if you reside in one of the 131 municipalities that make up the Metropolis of Greater your city. This can then reach 6000 euros, without forgetting an increase of the same amount as that of your conversion premium (within the limit of 1 euros).

The rules, conditions of access and the amounts of the conversion bonus which are mentioned below are valid for the period from June 1, 2021 to December 31, 2021 within the limit of the first 200 requests (beginning of July, 000% of this quota of 30 had already been reached). In all cases, it is imperative to be domiciled in Your country to benefit from it.

Vehicle sent to scrapping

The conversion bonus requires very specific prerequisites both with regard to the old vehicle intended for scrap and the new acquisition.

In the first case, the weight of the vehicle taken back and scrapped (car or van) must not exceed 3,5 tons. It can therefore be a private car (PC) or a van (CTTE). The vehicle must also be old enough: registered before January 2011 in the case of a diesel and registered before January 2006 in the case of a petrol model.

The vehicle must have belonged to the beneficiary of the premium for at least 1 year, not be pledged, be registered in Your country in a normal series or with a definitive registration number, not be considered as a damaged vehicle, and be returned for destruction in the 3 months preceding or the 6 months following the invoicing of the new vehicle.

New vehicle purchased or leased

The conditions of access to the conversion bonus are much less strict than those necessary to obtain the ecological bonus in terms of vehicle pollution. Even certain models of thermal cars are eligible. Below is the list of the types of vehicles which may be eligible for payment of the premium.

- Electric vehicles: rate of CO2 emissions less than or equal to 20 grams per kilometer

- Plug-in hybrid cars classified as Crit'Air category 1: rate of CO2 emissions less than or equal to 50 grams per kilometer

- Plug-in hybrid vans: CO2 emissions less than or equal to 50 grams per kilometer

- 2-wheel, 3-wheel or electric quadricycles without a lead-acid battery and whose maximum net engine power is at least equal to 2 or 3 kW

- Thermal vehicles classified as Crit'Air 1 or Crit'Air 2 category: rate of CO2 released between 51 grams and 137 grams per kilometer (in the case of a vehicle classified Crit'Air 2, it must be registered after the September 1, 2021)

For this last point, the CO2 emission threshold is lowered to 109 grams per kilometer instead of 137 grams in the following cases: if it is a vehicle registered before March 2021, a vehicle registered in the foreigner before being registered in Your country, or a wheelchair accessible vehicle.

Then, each of the types of vehicles mentioned above must meet five other criteria:

- The vehicle must be purchased or leased under a contract lasting at least 2 years

- The price of the vehicle must be less than or equal to 60 euros including tax

- The vehicle must be registered in Your country with a definitive number

- The vehicle should not be considered a damaged vehicle

- The vehicle must not be sold within six months of purchase or before having driven at least 6 kilometers

What is the amount of the conversion bonus in my case?

Several factors are taken into account to calculate the amount of the premium to which you can claim: the vehicle that you get rid of, the vehicle that will replace it, depending on whether your reference tax income per unit (2021 tax notice on your income for 2021) is greater or less than 18 euros, the cost of the new vehicle, if it is a new or used vehicle, its Crit'Air classification (the government has set up a simulator allowing the environmental class of your vehicle to be identified) or the fact that the purchaser is a natural or legal person are taken into account in particular.

As the number of potential situations is very high and the amounts are constantly subject to change, it is difficult to list all the possibilities here. To find out the value of the conversion bonus in your particular case, the easiest way is to go to the test page made available by the government. It's very fast and efficient, you just need to answer a few questions and the tool immediately tells you if you are eligible for the bonus and if so displays the exact amount for your situation.

For example, in the case of a gasoline vehicle registered before 2006 put for recycling, with a reference tax income divided by the number of shares of the tax household greater than 18 euros, for the purchase of a private vehicle or new light commercial vehicle electric or hydrogen whose price is less than 000 euros, we learn that it is possible to make a request to take advantage of a conversion bonus of 2 euros.

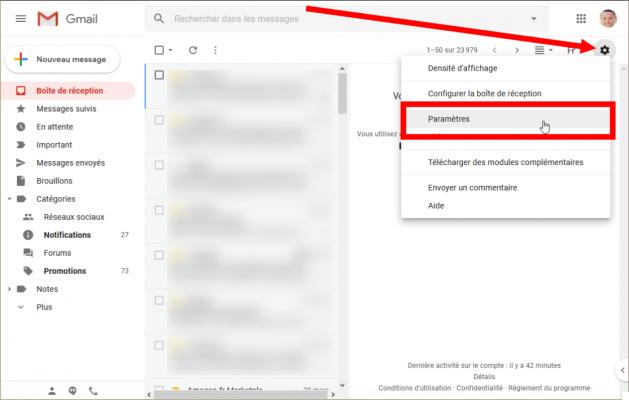

How to apply for the ecological bonus and the conversion bonus?

Now that you know what you are entitled to and that the process of purchasing the new vehicle is underway, you can submit your file to the Ministry of Ecological and Solidarity Transition.

The easiest and fastest way is to make an online request via the teleservice set up specially for this purpose. Just follow the steps shown on the screen and you're good to go. Connection to the platform is made with your login details Your countryConnect, which are also used to access services such as Ameli, taxes, Digital Identity La Poste and many others.

At the time of writing, file submissions for vehicles invoiced or ordered from June 1, 2021 are unavailable. The departments concerned need time to adapt to the new regulations which came into force on June 1. Here are the dates on which requests will be possible again:

- Le July 17, 2021 for an ecological bonus file only

- Le July 31, 2021 for a conversion bonus file only

- Le July 31, 2021 for an ecological bonus file and a conversion bonus at the same time

You also have the option of making a request by mail, but expect longer response times in this case. If you are reading these lines, you probably have internet access, so it is better to do the procedure online.

- Share

- Tweet

- Share

- Envoyer à un ami

![[Review] Samsung Powerbot VR7000: the robot vacuum cleaner from Star Wars](/images/posts/6bc44de38605b5c0fa12661febb1f8af-0.jpg)